This increase in gross profits will occur because of the lower inventory carrying amounts of the liquidated units. The lower inventory carrying amounts are used for the cost of sales while the sales are reported at current prices. The gross profit on these units is higher than the gross profit that would be recognized using more current costs. These inventory-related profits caused by LIFO liquidation are however one-time events and are unsustainable. Therefore, the stockholders must be able to find a uniform space to analyze any company’s health irrespective of cost method. Under the LIFO, it is assumed that the inventory that arrives most recently is the one that is used or consumed up first.

US Foods Reports Third Quarter Fiscal Year 2024 Earnings

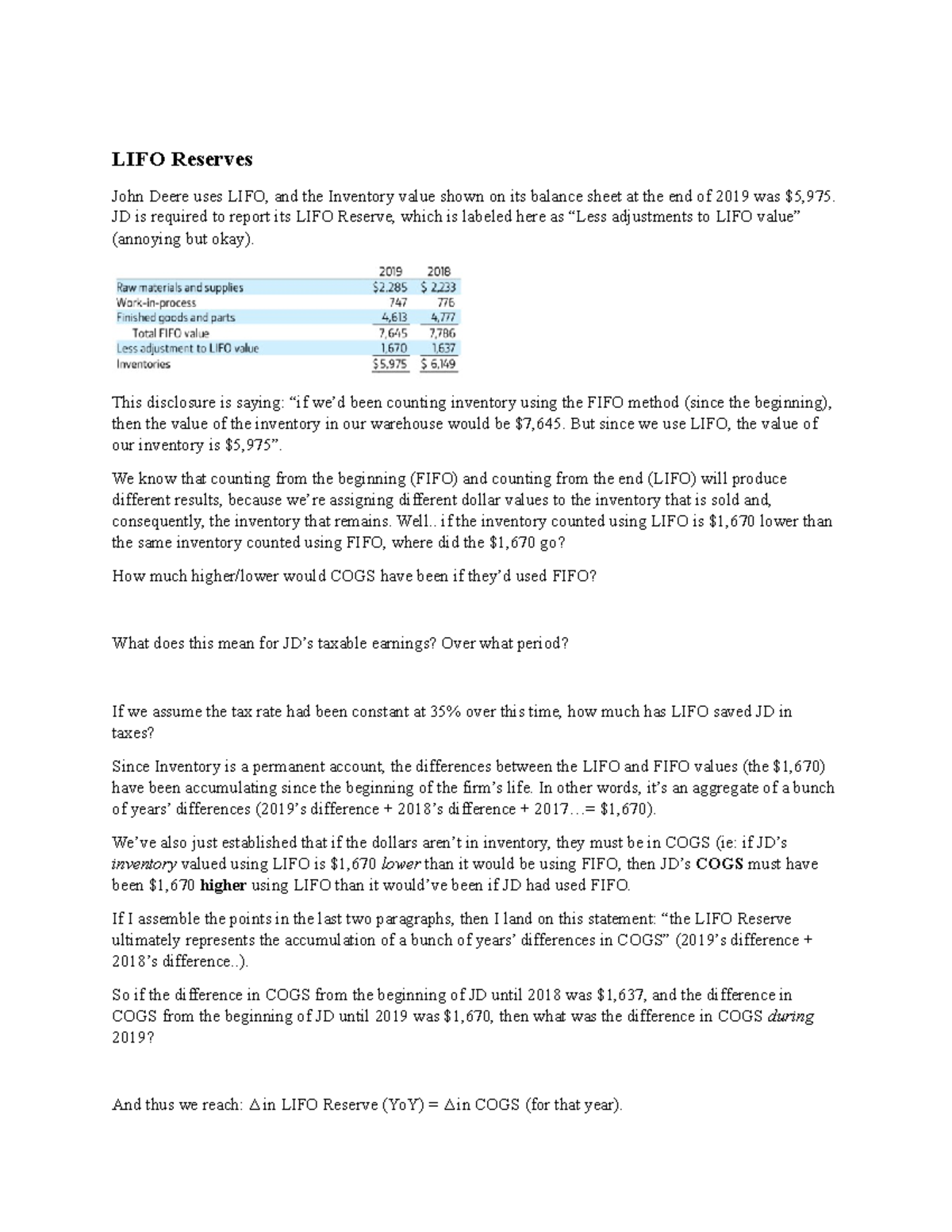

The LIFO reserve is an important accounting concept that allows companies to align the value of inventory on their balance sheets with current replacement costs. The LIFO reserve formula calculates the difference between the inventory value reported using the LIFO method, which assumes the newest inventory items are sold first, and the value using the FIFO method, which assumes oldest inventory items are sold first. The LIFO method is applied for external reports, such as tax returns, given that the LIFO method assigns a higher cost to the goods sold during the year. By raising the cost, less taxable income is reported on the income statement; thus, the overall tax expense is also reduced. In order for external users to not be mislead about the true value of inventory, cost of goods sold, and profitability of the company, there needs to be a reconciliation between the two valuation methods. With reports that show a higher cost to the company, it also means that less income eligible for taxes is reported alongside it.

Best Account Payable Books of All Time – Recommended

The year-to-year changes in the balance within the LIFO reserve can also give a rough representation of that particular year’s inflation, assuming the type of inventory has not changed. We believe that Adjusted Net income may be used by investors, analysts, and other interested parties to facilitate period-over-period comparisons and provides additional clarity as to how factors and trends impact our operating performance. If the LIFO reserve account balance goes up or down, additional costs are then added on to the costs of the goods the company has sold throughout the year. This information is integral for investors because it enables them to see how inflation affects the value of the company’s inventory, or it allows them to determine the taxation benefits of using the LIFO or FIFO accounting methods. The LIFO reserve comes about because most businesses use the FIFO, or standard cost method, for internal use and the LIFO method for external reporting, as is the case with tax preparation.

Considerations for Financial Reporting and Shareholders

- It bridges the gap between LIFO and FIFO, ensuring transparency about inventory valuation and supporting accurate financial statements.

- It holds relevance as it enables various stakeholders in the business and Analyst community to understand and compare the company’s reported profitability and various financial ratios with companies using the FIFO method of Inventory reporting in a better way.

- In order for external users to not be mislead about the true value of inventory, cost of goods sold, and profitability of the company, there needs to be a reconciliation between the two valuation methods.

- We undertake no obligation to update or revise any forward-looking statements, except as may be required by law.

- However, tis concept is limited to the US mainly because the LIFO metgod is allowed only as per the Generally Accepted Accounting Principles (GAAP).

The main purpose of LIFO Reserve is to bridge the gap between the costs when using LIFO Method and costs when using the FIFO method. FIFO method better approximates the flow of cost of goods sold, so we will calculate the inventory turnover ratios by converting Company B inventories and cost of good sold to equivalent FIFO basis. XYZ International Limited uses the FIFO method for internal reporting and the LIFO method for external reporting. At the yearend Inventory as per FIFO stands at $ under the FIFO method and $70000 under the FIFO method. At the beginning of the Year, the company’s LIFO Reserve showed a credit balance of $25000.

The entry effectively increases the cost of goods sold, as under the LIFO method the most recent (and therefore higher cost) items sell first. The balance on the LIFO reserve will represent the difference between the FIFO and LIFO inventory amounts since the business first started using the LIFO inventory method. A reconciliation of purchases of property and equipment to capital expenditures and IT capital, a non-GAAP financial measure, is provided in Table 5. A reconciliation of net earnings to adjusted EBITDA, a non-GAAP financial measure, is provided in Table 2. Share-based compensation expense for expected vesting of stock awards and employee stock purchase plan. During the third quarter of fiscal year 2024, the Company repurchased 10.4 million shares of common stock at an aggregate purchase price of $580 million.

LIFO Reserve: Guide to Accurate Inventory Valuation

Maintaining accurate inventory counts ensures the LIFO reserve aligns with reality. The combined impact is an increased COGS and reduced net income, which can increase tax liability. This reserve amount essentially represents the deferred tax liability that would need to be paid if the company ever liquidates its LIFO-based inventory.

Learn about emerging trends and how staffing agencies can help you secure top accounting jobs of the future. We’re a headhunter agency that connects US businesses with elite LATAM professionals who integrate seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%. A is incorrect because a decline in the married filing separate status on your 2021 or 2022 tax return from the prior period may indeed indicate that LIFO liquidation has occurred. Throughout this article, we’ve talked about many benefits and reasons why calculating the LIFO Reserve helps companies. This article will help you understand the concept of LIFO Reserve, its formula, and its implications. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

The problem with LIFO is that it only works in an economy where the cost of things is constantly rising. Most countries have prohibited the use of this accounting technique except under very special circumstances. Companies should perform complete physical inventory audits periodically, such as annually, to verify inventory quantities on-hand. Audits help uncover any counting errors, theft, damage, obsolescence issues, or other problems causing differences between booked LIFO reserve levels and actual inventory. More frequent cycle counts focused on high-value SKUs also contribute to improved precision of LIFO figures between full audits.