To help with bank statement reconciliation, we also created a free Excel template for download for bank statements and cash accounts. A reconciled transaction is an accounting transaction verified and matched to the bank statement. Once the transaction is matched, it will show as reconciled in the accounting records. You can use different sets of figures depending on what you are trying to achieve. In business, this would typically mean debits recorded on a balance sheet and credits on an income statement. Balancing financial records is a fundamental principle in any company or business.

Cash and Accrual Accounting

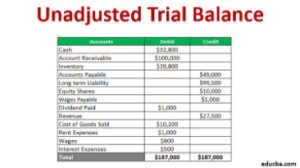

The reconciliation process includes reconciling your bank account statements, but it also includes a review of other accounts and transactions that need to be completed regularly. Accountants typically perform an account reconciliation for all their asset, liability, and equity accounts. This process involves reconciling credit card transactions, accounts payable, accounts receivable, payroll, fixed assets, and subscriptions to ensure that are stocks real assets all are properly accounted for and balanced.

If you’ve ever been billed for an item you didn’t buy or found yourself with a larger bank balance than you know you should have, you understand the importance of account reconciliation. Account reconciliation should be prepared and carried out by qualified accounting personnel, typically within the finance department. Ideally, it should be someone who is not involved in the day-to-day transactions that performs it to maintain objectivity and ensure a thorough review. Account reconciliation is a crucial function in business accounting that helps address several fundamental objectives in the accounting process. Angela has used and tested various accounting software packages; she is Xero certified and a QuickBooks ProAdvisor. Experienced in using Excel spreadsheets for her bookkeeping needs and created a collection of user-friendly templates designed specifically for small businesses.

What Is Month-End Reconciliation?

Reconciliation is typically done at regular intervals, such as monthly or quarterly, as part of normal accounting procedures. For example, reconciling general ledger accounts can help maintain accuracy and would be considered account reconciliation. While reconciling your bank statement would be considered a financial reconciliation since you’re dealing with bank balances. A common example of account reconciliation is comparing the general ledger to sub-ledgers, such as accounts payable or accounts receivable. This ensures that all transactions are recorded accurately and any discrepancies are identified and corrected. At the end of each month, you diligently reconcile your balance sheet accounts.

Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business. Lastly, in the United States, account reconciliation is crucial to help companies comply with federal regulations applied by the Securities and Exchange Commission (SEC) under the Sarbanes-Oxley Act. Businesses worldwide must also comply with all local laws and regulations.

A small business may have a simple income and expenses ledger and bank account; they will only need a bank reconciliation to the bank statement. Every business requires financial statements to calculate its business profits and to track its financial performance. Financial statements include the income statement, balance sheet and cash flow statement. The company should ensure that any money coming into the company is recorded in both the cash register and bank statement. If there are receipts recorded in the internal register and missing in the bank statement, add the transactions to the bank statement.

- That’s why account reconciliation remains a key component of the financial close process.

- Reconciliation has become a byword for consistency, accuracy, and thoroughness.

- It ensures that the financial account balances are accurate and up-to-date.

- It also enables you to monitor cash flow and control the potential for theft.

- This helps ensure that the company pays vendors and suppliers accurately and on time.

Why is account reconciliation important for businesses?

Account reconciliation is typically carried out at the end of an accounting period, such as monthly close, to ensure that all transactions have been accurately recorded and the closing statements are correct. Reconciliation for accounts receivable involves matching customer invoices and credits with aged accounts receivable journal entries. It makes sure that your customer account write-offs are correctly recorded against the Allowance for Doubtful Accounts and that discrepancies are addressed. Here, you reconcile general ledger accounts related to short-term investments with a maturity period of 90 days or less. Examples include treasury bills, commercial paper, and marketable securities. This reconciliation makes sure that your financial records match the balances on brokerage or financial institution statements.

GAAP requires that if the direct method is used, the company must reconcile cash flows to the income statement and balance sheet. Account reconciliations can also help identify bank and credit card errors. Though rare, it’s not unheard of that a bank or credit card company makes an error on your account, perhaps deducting funds for a check that isn’t yours, or charging you for a purchase that you never made. One of the most important things you can do to keep your general ledger accurate is to perform a bank reconciliation monthly. Account reconciliation is a process that involves identifying discrepancies between business ledgers and outside source documents. Accuracy and strict attention to detail are the fundamental principles of this process.

Reconciliation is also used to ensure how to make an invoice to get paid faster there are no discrepancies in a business’s accounting records. This works by comparing 2 sets of records and is a way of making sure all the figures are correct and match up. Reconciliation has become a byword for consistency, accuracy, and thoroughness. A company may issue a check and record the transaction as a cash deduction in the cash register, but it may take some time before the check is presented to the bank. In such an instance, the transaction does not appear in the bank statement until the check has been presented and accepted by the bank.

Various factors, such as timing differences, missing transactions, and mistakes can cause these discrepancies. Most account reconciliations are performed against the general ledger, considered the master source of financial records for businesses. Intercompany reconciliation is a process that occurs between units, divisions, or subsidiaries of the same parent company. This type of accounting software reconciliation involves reconciling statements and transactions to ensure that all business units are on the same page financially.